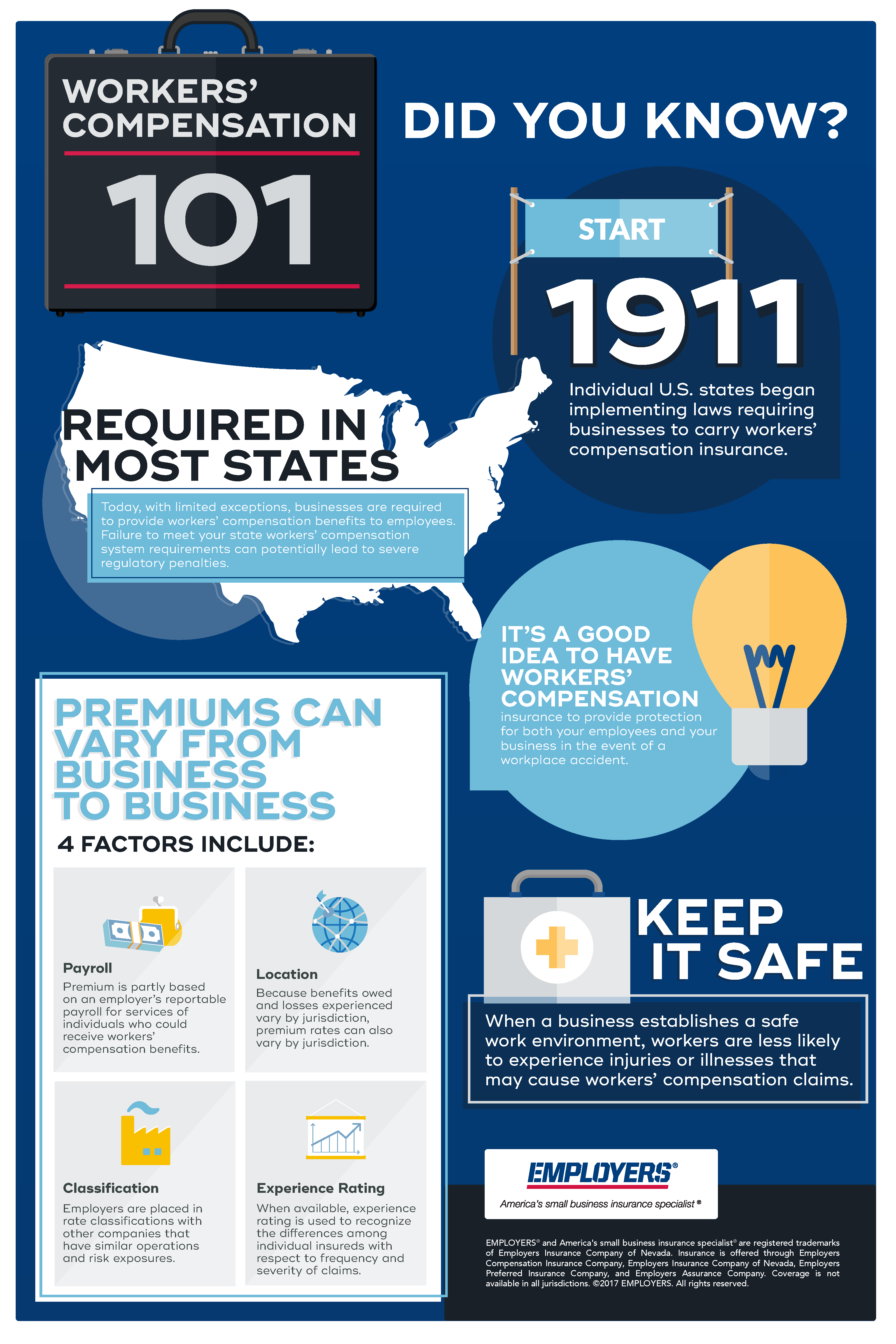

Workers’ Compensation 101 Infographic

What Is Workers’ Compensation Insurance?

Workers’ compensation insurance covers businesses for their statutory and legal obligations for employee expenses that are a direct result of on-the-job injuries and/or illnesses. While plans may differ from state to state, workers’ compensation can include weekly payments in place of wages, compensation for economic loss (past and future), reimbursement or payment of medical expenses, and benefits payable to the dependents of workers killed on the job or in the course of employment. Workers’ compensation insurance policies generally do not include damages for pain and suffering, or punitive damages for employer negligence.

Workers’ compensation laws generally provide no fault benefits to employees—meaning that injured workers can (in most cases) collect workers’ compensation benefits regardless of whether they caused their own injury. They also provide the predictability of an exclusive remedy to businesses—injured workers are provided defined benefits as compensation for their injury. State laws establish comprehensive and specific benefits that must be provided to workers who suffer a work-related injury or illness. Usually, businesses obtain workers’ compensation protection from one of four sources: private insurance carriers, like EMPLOYERS®, state insurance funds, self-insurance, or self-insured groups.

When Did Workers’ Compensation Insurance Start?

Workers’ compensation insurance originated in Germany in 1870 to address the social costs of workers’ injuries arising from the industrial revolution. Back then, workers who had been injured or made ill on-the-job had to take legal action against their employers to receive compensation. This made it difficult for workers to obtain timely compensation for workplace injuries and also exposed businesses to potentially devastating lawsuits.

Starting in 1911 in the U.S., individual states began implementing laws domestically, requiring businesses to carry workers’ compensation coverage. Wisconsin was first, but other states quickly followed in enacting a “no fault” system intended to help workers receive fair and prompt medical treatment and financial compensation for workplace injuries and illnesses. This compromise system also established limits on the obligations of businesses for workplace exposures, making costs more predictable and affordable.

Do I need Workers’ Compensation Coverage?

Generally speaking, businesses must obtain workers’ compensation coverage if they have employees that are not owners of the company. Most states allow sole proprietors and partners to purchase coverage, but it is not required. Check your state’s laws for further information on which types of employees need workers’ compensation coverage.

Businesses with contract employees should take special care in evaluating their workers’ compensation needs. Most states will treat an uninsured contractor or subcontractor as your employee if he or she is injured while doing work for your company.

For more information about workers’ compensation insurance, call us at 1-888-682-6671 or visit our Request a Quote page.