Today’s self‑insured organizations need more than just coverage; they need an intelligent risk management solution that optimizes their businesses. EMPLOYERS delivers by combining unparalleled flexibility, cutting edge analytics, and extensive industry knowledge to transform self-insurance into a driver of measurable savings.

About Excess Workers’ Compensation Insurance

Why Self-Insurance?

Self-insurance allows organizations with strong risk management practices to take greater control of their workers’ compensation programs. Rather than paying a fixed premium for guaranteed cost coverage, self-insured employers retain a portion of their workers’ compensation risk and pay claims as they occur—creating opportunities for improved cash flow, greater transparency, and long-term cost savings.

For large employers, public entities, groups, and pools, self-insurance can be a strategic financial decision. When paired with effective safety programs, claims management, and data-driven insights, self-insurance enables organizations to align risk with their operational and financial goals—while maintaining flexibility as exposures evolve.

How Excess Workers’ Compensation Works

Excess workers’ compensation insurance is designed to protect self-insured organizations from severe or catastrophic losses.

Under a self-insured program, the employer is responsible for workers’ compensation claims up to a defined retention level. Excess workers’ compensation coverage applies when a claim exceeds that retention, providing financial protection against high-severity losses that could otherwise significantly impact an organization’s balance sheet.

Excess workers’ compensation programs can be structured to reflect an organization’s specific risk tolerance, industry exposures, and financial priorities. Coverage is supported by advanced analytics, claims oversight, and risk management resources that help organizations identify trends, manage volatility, and optimize their total cost of risk.

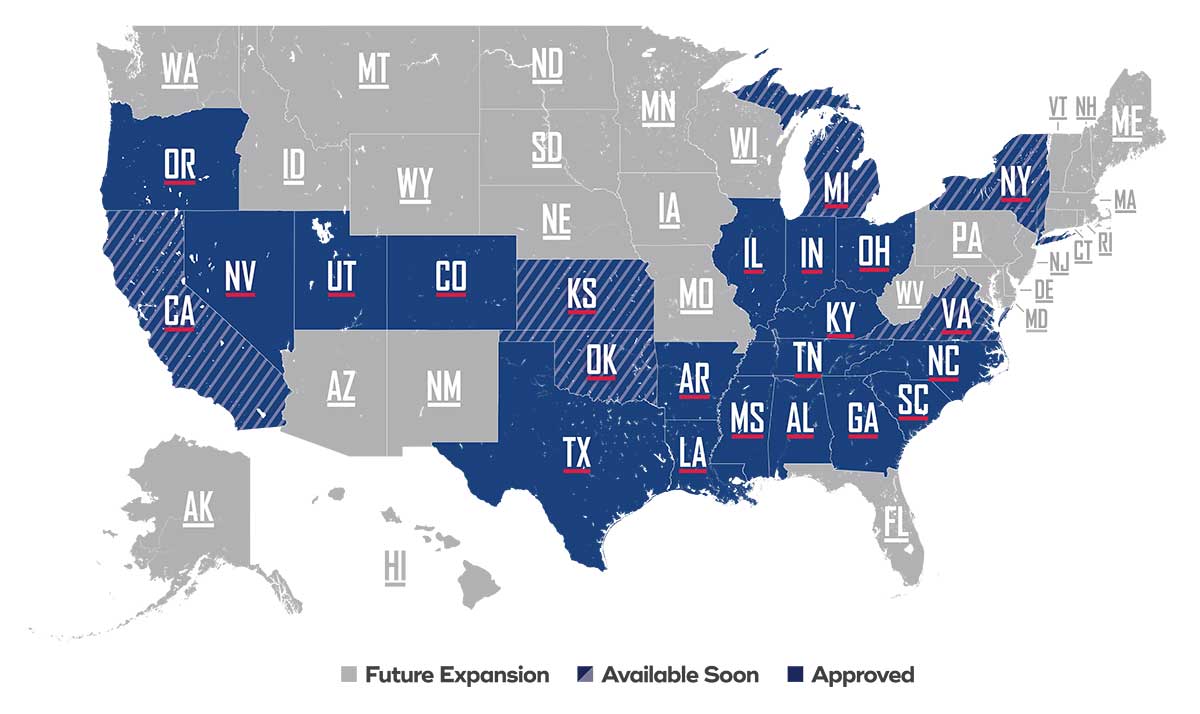

EMPLOYERS’ Excess Workers’ Compensation Service Area

EMPLOYERS also offers primary workers’ compensation insurance for businesses that do not wish to self-insure, with a nationwide footprint. View our service map.

Industries We Serve – Excess Workers’ Compensation

EMPLOYERS, through Employers Assurance Company, provides excess workers’ compensation solutions for a wide range of industries with complex risk profiles.

Construction

Target Classes:

- Commercial and Residential Construction

- Civil Contractors

- Specialty Trade Construction

Education

Target Classes:

- Colleges

- University Systems

- Community Colleges

- Research Institutions

- K-12 School Districts

- Private and Charter Schools

- Educational Services

- School Pools and Groups

Group Self Insurance

Target Classes:

- Homogenous and Heterogeneous Groups

- Pools

- Risk Retention Groups

- Joint Powers Authorities

- Associations

Healthcare

Target Classes:

- Healthcare Systems

- Hospitals

- Assisted Living Facilities

- Medical Research Facilities

Manufacturing & Industrial

Target Classes:

- Electronics

- Food Production

- Machinery

- Automotive

- Textiles

Public Entities

Target Classes:

- Municipalities

- Public Agencies

- Cities, Towns, Townships

- Special Districts

- Pools

- K-12 School Districts

Retail

Target Classes:

- Home Goods and Décor

- Warehouse and Membership Clubs

- Home Improvement

- Apparel and Fashion

- Sporting Goods

- General Retail

Service

Target Classes:

- Hospitality

- Restaurants

- Financial Services

- Professional Services

Transportation & Logistics

Target Classes:

- Trucking and Motor Freight

- Transit Authorities

- Specialized Hauling

- Warehousing, Distribution and 3PL

In addition to excess coverage, EMPLOYERS also offers primary workers’ compensation insurance with a nationwide footprint for businesses that do not wish to self-insure. Learn about our appetite.

Risk Management Services

EMPLOYERS’ Risk Management Services help you move beyond managing claims to actively controlling risk. By combining advanced analytics, on-demand resources, and real-time visibility, we enable you to anticipate issues, take action sooner, and measure results with confidence. Together, these capabilities reduce loss frequency and severity while strengthening your overall risk strategy.

Predictive & Prescriptive Modeling

Stop reacting to claims and start anticipating them. EMPLOYERS leverages advanced machine learning algorithms trained on vast libraries of workers’ compensation data to identify emerging risk patterns before they become costly claims. Our predictive models analyze hundreds of variables across your workforce, operations, and industry trends to forecast potential exposures.

But we don’t stop at prediction. Our prescriptive analytics engine delivers actionable, prioritized recommendations tailored to your specific risk profile, giving you a clear roadmap to reduce claim frequency and severity. Transform from reactive risk management to proactive risk intelligence and gain the foresight to protect your workforce and your bottom line.

On-Demand Risk Advisory Services

Your safety challenges don’t wait and neither should your solutions. EMPLOYERS puts a network of industry-specialized safety resources at your fingertips, available exactly when you need them. Whether you’re navigating a sudden claims spike, expanding into new operations, launching a safety initiative, or preparing for a regulatory inspection, our experienced risk advisors can help identify practical guidance within moments, not weeks.

Each resource is customized to your industry, your operations, and your specific challenge. We help you understand important considerations for inspection readiness, strengthen your return-to-work protocols, and empower your team to build robust safety programs, from ergonomic best practices to fleet safety and facility hazard management. EMPLOYERS transforms risk advisory support from a scheduled service into a strategic capability you can deploy at a moment’s notice.

Interactive Claims Dashboard

See your risk program with unprecedented clarity. EMPLOYERS delivers interactive visibility into every dimension of your claims activity through dynamic dashboards designed for the way you work.

- Track open claim progress, analyze trends by location, department, or injury type, all updated and accessible from any device.

- Drill down from high-level KPIs to individual claim details with a single click.

- Build custom views for different stakeholders, from C-suite executives who need strategic snapshots to risk managers who require granular operational data.

Our dashboards notify you of developing situations before they escalate. With EMPLOYERS, you’re never more than seconds away from the insights that drive smarter decisions.

Industry Benchmarking

Know where you stand and where you can go. EMPLOYERS benchmarking intelligence compares your program’s performance against matched peer organizations in your industry, region, and size category. Understand whether your loss trends reflect internal operational issues requiring attention or broader industry conditions affecting everyone. Identify performance gaps and uncover opportunities for improvement that would otherwise remain hidden.

Our benchmarking reports highlight your strengths, pinpoint areas where peers are outperforming you, and quantify the potential savings from closing those gaps. With EMPLOYERS, you gain the competitive intelligence to set meaningful goals, measure true progress, and demonstrate the value of your risk management investments to leadership.

Total Cost of Risk Optimization

Design a program that works as hard as you do. EMPLOYERS takes a comprehensive view of your total cost of risk, analyzing the intricate relationships between retentions, attachment points, premium structures, and projected claim costs to engineer a program structure perfectly aligned with your financial objectives and risk tolerance.

Our actuarial modeling simulates multiple scenarios, stress-testing different configurations against historical patterns and forward-looking projections. The result is a customized program architecture that optimizes your risk financing strategy, balances cash flow considerations, and positions your organization to turn insurance from a necessary expense into a source of competitive advantage. With EMPLOYERS, you don’t just buy coverage; you invest in a strategic asset.

Submissions and Inquiries

For submissions, inquiries, or questions about our excess workers’ compensation product, please email ExcessWC@employers.com.