Colorado contains some of the most stunning scenery in the world, and is also home to over 650,000 small businesses, a thriving agriculture and mining industry, and technology and scientific research companies.

Protecting Colorado’s small businesses and their workers is what EMPLOYERS® Insurance is all about. Get an explanation of how workers’ compensation insurance works, plus details specific to insurance for Colorado businesses below.

Workers’ Compensation History in Colorado

The Colorado Workers’ Compensation Act was enacted in 1915. The law mandates that employers cover medical care and provide wage replacement for injured workers. As part of the bargain, workers’ compensation is the exclusive remedy for workers injured on the job, and businesses are protected from costly, time-consuming lawsuits.

Learn How Workers’ Comp Insurance Works

Workers’ Compensation Costs in Colorado

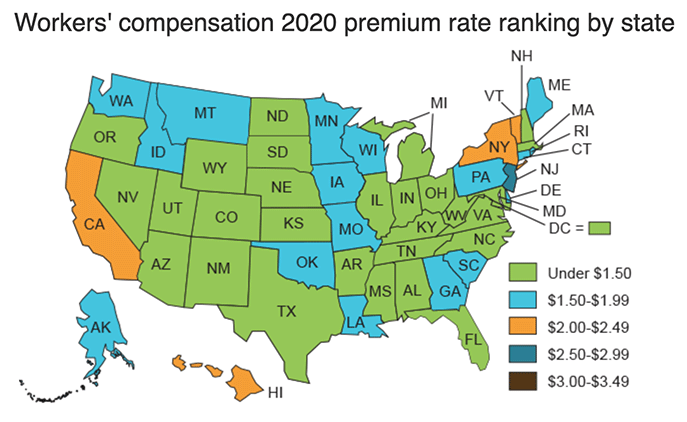

The amount a business owner pays for a workers’ comp policy in Colorado varies based on state requirements, the level of risk associated with the industry and jobs in their business, and the size of their payroll. To get a rough idea of what Colorado business owners might pay for workers’ compensation insurance premiums compared to the rest of the nation, check the map below:

Source: Oregon Department of Consumer and Business Services, 2020

This study by the State of Oregon’s Department of Consumer and Business Services shows workers’ compensation insurance is projected to cost under $1.50 for every $100 of payroll in Colorado. The best way to understand costs, benefits, and other policy details is to connect with a local agent to get a quote.

Colorado Workers’ Comp Forms Library

Each state has different requirements for workers’ compensation forms and claims processing. Colorado may require business owners to print and post some workers’ compensation forms and notices at their workplace. Visit the Colorado Claim Forms page to get full details and download these forms and notices in English and Spanish:

Visit Colorado’s Claim Forms Library

Have questions on the forms and notices required for Colorado businesses? Your insurance agent can help, or if you’re a new business looking for an agent, reach out and we’ll connect you with a local EMPLOYERS agent to guide you.

More Colorado Workers’ Comp Resources

Colorado’s Injured Employee Hotline℠

Call to Report a Claim Now: 855-365-6010 – open 24 hours a day, 7 days a week. Staffed by registered nurses specifically trained to provide medical guidance over the phone for work-related occupational disease or injury.

*For emergency treatment please dial 911*

Those who have already received medical treatment, but are reporting a claim for the first time can call our care team at 1-888-682-6671.

Colorado HR, Safety & Risk Support

EMPLOYERS also offers human resources, safety and risk support for our business owners through our Loss Control Connection℠. We go beyond the standard for workers’ comp insurance providers to offer tools and resources to improve employee wellbeing. Examples include:

- Ideas for simplifying tedious tasks like developing job postings, job descriptions and salary benchmarking.

- Templates for employee safety guidelines and handbooks.

- Content delivery customized by business and automatically updated to compliance standards with Colorado’s statutes and federal law.

- Employee documents available in both English and Spanish.

- A forum to share questions on workplace safety situations, risk management, and human resources quickly answered by other users with similar experiences.

- Automated news feed features to help business owners and employees meet and maintain training requirements more easily.

As part of our commitment to each business’ success, EMPLOYERS Insurance makes all these resources and more available to policyholders. Find out more below.

See the Full Benefits of

Workmans’ Comp Coverage You Need

Interested in learning more about how EMPLOYERS helps protect small businesses and workers in Colorado? Get started now with workers’ compensation insurance from EMPLOYERS!

EMPLOYERS is America’s Small Business Insurance Specialist®, focusing on providing small businesses in Colorado with the workers’ compensation insurance agent and policy that is the right for their business.

In Colorado, insurance is offered through Employers Compensation Insurance Company, Employers Assurance Company and Employers Preferred Insurance Company. Not all insurers do business in all jurisdictions.